The company reports on its financial performance on a quarterly basis starting its financial year on January 01.

Results published on March 4, 2025:

The company reports on its financial performance on a quarterly basis starting its financial year on January 01.

For the Idorsia-led portfolio in 2025, the company expects a continued acceleration of QUVIVIQ with net sales of around CHF 110 million, COGS of around CHF 15 million, SG&A expenses of around CHF 210 million, and R&D expense of around CHF 100 million, leading to non-GAAP operating expenses of around CHF 325 million. This performance would result in an Idorsia-led business non-GAAP operating loss of around CHF 215 million and US-GAAP operating loss of around CHF 260 million. The company expects US-GAAP EBIT for the partnered business of around CHF 105 million, mainly driven by the amended deal with Viatris. This would result in a US-GAAP loss for the global business of around CHF 155 million. All amounts exclude unforeseen events and potential revenue related to additional business development activities.

(March 2025)

Arno Groenewoud

Chief Financial Officer

| Full Year | Fourth Quarter | |||

|

in CHF millions, except EPS (CHF) and number of shares (millions) |

2024 | 2023 | 2024 |

2023 |

|

Net revenues |

113 |

152 |

60 |

22 |

|

Operating expenses |

(351) |

(409) |

(140) |

(134) |

|

Operating income (loss) |

(232) |

(255) |

(78) |

(111) |

|

Net income (loss) |

(264) |

(298) |

(84) |

(117) |

|

Basic EPS |

(1.45) |

(1.67) |

(0.45) |

(0.65) |

|

Basic weighted average number of shares |

182.4 |

178.2 |

188.3 |

178.6 |

|

Diluted EPS |

(1.45) |

(1.67) |

(0.45) |

(0.65) |

|

Diluted weighted average number of shares |

182.4 |

178.2 |

188.3 |

178.6 |

Net revenue of CHF 113 million in 2024 is the result of QUVIVIQ product sales (CHF 61 million), product sales to partners (CHF 47 million), and contract revenues (CHF 5 million). This compares to net revenue of CHF 152 million in 2023, which included CHF 107 million one-off incomes (mainly PIVLAZ sales in Japan and the APAC (ex-China) Nxera deal). Other revenues in 2023 consisted of QUVIVIQ product sales (CHF 31 million), and other contract revenue of CHF 15 million.

US GAAP operating expenses in 2024 (CHF 351 million) and 2023 (CHF 409 million) were impacted by one-off incomes of CHF 125 million (Viatris deal) and CHF 298 million (Nxera deal) respectively. Excluding these one-off incomes, US GAAP operating expenses in 2024 amounted to CHF 476 million, decreasing by CHF 231 million compared to 2023 (CHF 707 million), mainly driven by R&D expenses of CHF 144 million decreasing by CHF 150 million compared to 2023 (CHF 294 million), and SG&A expenses of CHF 273 million decreasing by CHF 120 million compared to 2023 (CHF 392 million).

US GAAP net loss in 2024 amounted to CHF 264 million (CHF 298 million in 2023). The net loss was favorably impacted by the one-off income related to the Viatris deal (Nxera deal in 2023) and lower operating expenses throughout all functions. The reduction in operating expenses is mainly a result of the restructuring initiative from 2023 which became fully cost effective in 2024 and the Viatris Deal, which relieved the group from Phase 3 development costs related to selatogrel and cenerimod.

The US GAAP net loss resulted in a net loss per share of CHF 1.45 (basic and diluted) in 2024, compared to a net loss per share of CHF 1.67 (basic and diluted) in 2023.

| Full Year | Fourth Quarter | |||

|

in CHF millions, except EPS (CHF) and number of shares (millions) |

2024 | 2023 | 2024 |

2023 |

|

Net revenues |

113 |

152 |

60 |

22 |

|

Operating expenses |

(427) |

(654) |

(121) |

(137) |

|

Operating income (loss) |

(308) |

(501) |

(60) |

(115) |

|

Net income (loss) |

(330) |

(542) |

(73) |

(121) |

|

Basic EPS |

(1.81) |

(3.04) |

(0.39) |

(0.68) |

|

Basic weighted average number of shares |

182.4 |

178.2 |

188.3 |

178.6 |

|

Diluted EPS |

(1.81) |

(3.04) |

(0.39) |

(0.68) |

|

Diluted weighted average number of shares |

182.4 |

178.2 |

188.3 |

178.6 |

Non-GAAP net loss in 2024 amounted to CHF 330 million; the difference versus US GAAP net loss was mainly driven by a net gain from the Viatris Deal (CHF 125 million).

The non-GAAP net loss resulted in a net loss per share of CHF 1.81 (basic and diluted) in 2024, compared to a net loss per share of CHF 3.04 (basic and diluted) in 2023.

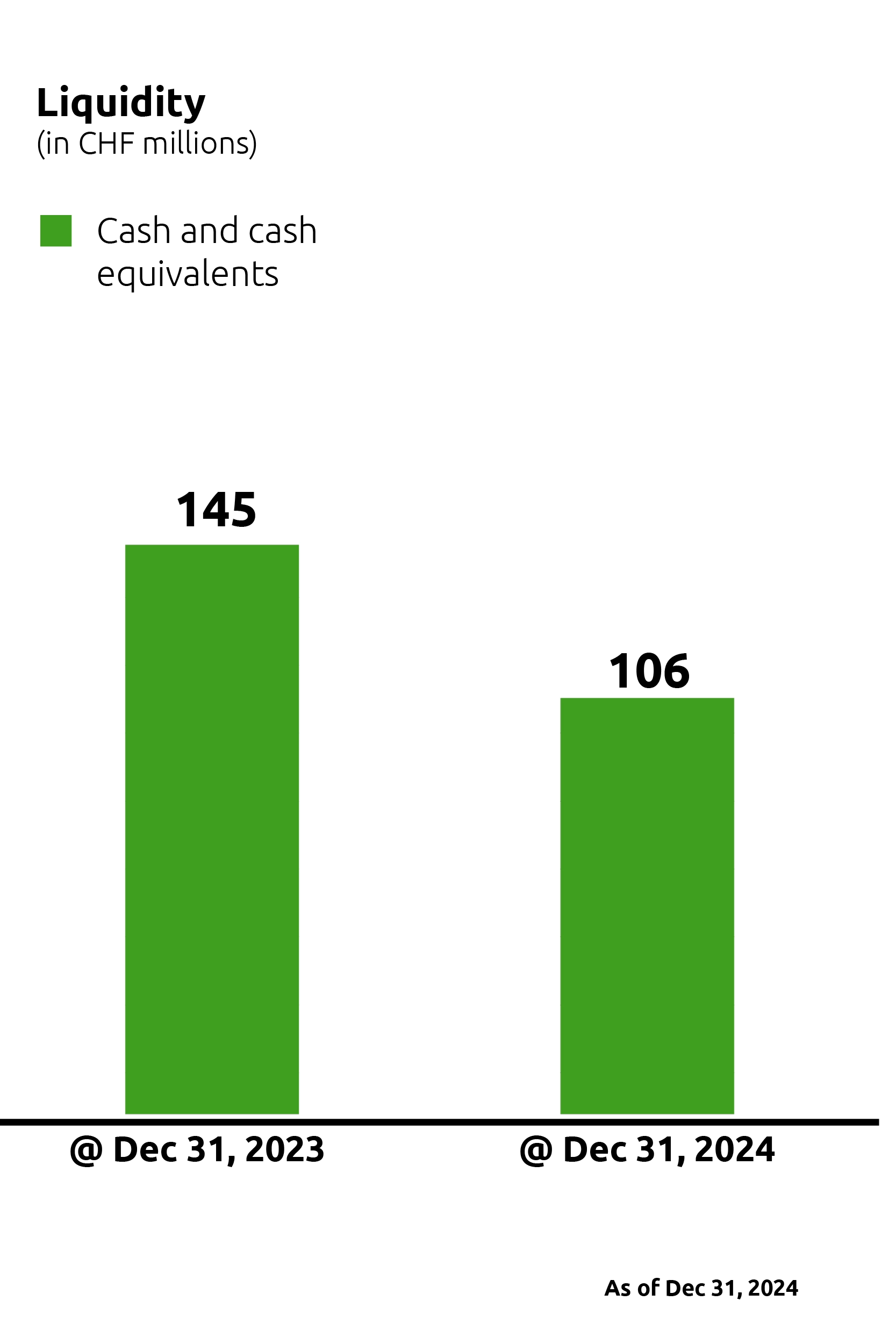

At the end of 2024, Idorsia’s liquidity amounted to CHF 106 million.

| Type of debt | Dec 31, 2024 | Sep 30, 2024 |

Dec 31, 2023 |

|

Convertible loan |

CHF 335 million | CHF 335 million | CHF 335 million |

|

Convertible bond |

CHF 797 million | CHF 797 million | CHF 796 million |

|

Other financial debt |

CHF 189 million | CHF 162 million | CHF 162 million |

| Total indebtedness | CHF 1,321 million | CHF 1,294 million |

CHF 1,293 million |

* rounding difference may occur

Here we provide a 5-year archive of our financial reports and related reporting documentation.

Results published on March 4, 2025:

Results published on October 29, 2024.

Results published on July 25, 2024.

Results published on May 21, 2024:

Results published on May 21, 2024:

Results published on October 24, 2023:

Results published on July 25, 2023:

Results published on April 25, 2023:

Results published on February 7, 2023:

Results published on October 25, 2022:

Results published on July 26, 2022:

Results published on April 26, 2022:

Results published on February 8, 2022:

Results published on October 26, 2021:

Results published on July 27, 2021:

Results published on April 22, 2021:

Results published on February 4, 2021:

Results published on October 27, 2020:

Results published on July 23, 2020:

Results published on April 23, 2020:

Results published on February 6, 2020:

Results published on October 22, 2019:

Results published on July 23, 2019:

Results published on April 18, 2019: